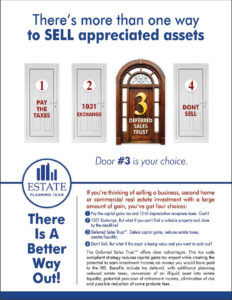

If you’re thinking of selling a business, second home or commercial real estate investment with a large amount of gain, you’ve got four choices:

- Pay the capital gains tax and 1245 depreciation recapture taxes. Ouch!

- 1031 Exchange. But what if you can’t find a suitable property and close by the deadline?

- Deferred Sales Trust. Defers capital gains, reduces estate taxes, creates liquidity.

- Don’t Sell. But what if the asset is losing value and you want to cash out?

The Deferred Sales Trust offers clear advantages. This tax code compliant strategy reduces capital gains tax impact while creating the potential to earn investment income on money you would have paid to the IRS. Benefits include tax deferral, with additional planning reduced estate taxes, conversion of an illiquid asset into estate liquidity, potential provision of retirement income, elimination of risk and possible reduction of some probate fees.

The content below restricted to registered Reef Point affiliates and partners. If you are an existing user, please log in. If you wish to become a Reef Point partner, please register below for consideration.