How providing the perfect capital gains tax solution for your clients will increase your sales.

Introducing the Deferred Sales Trust™

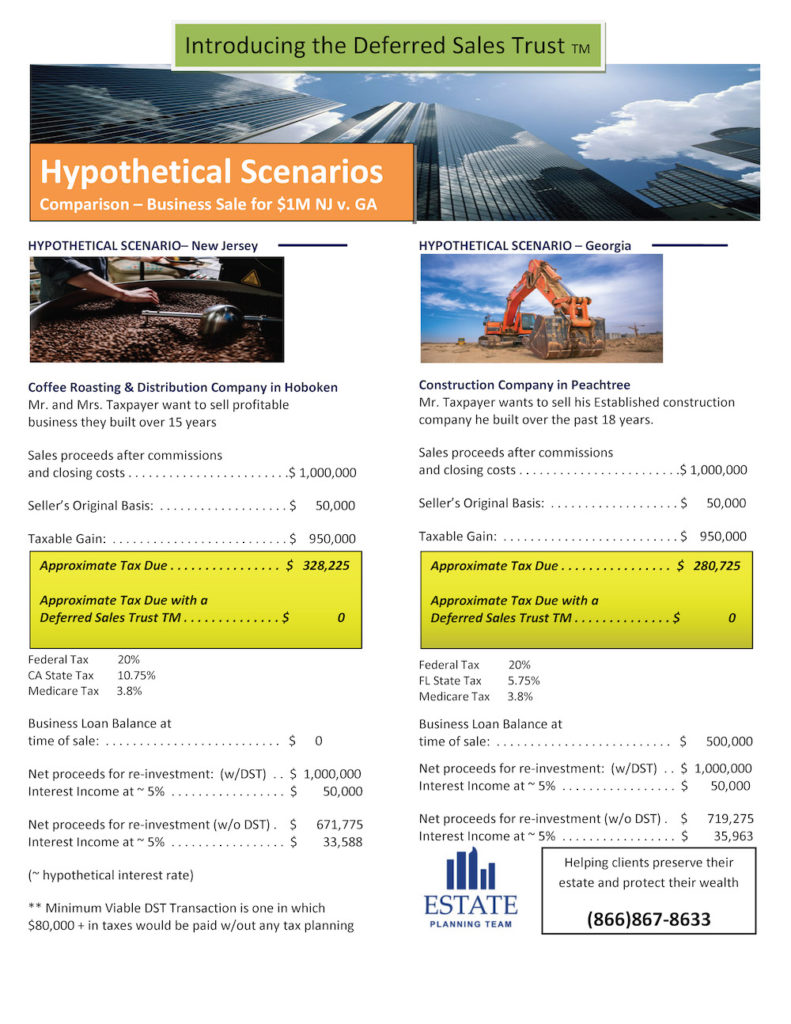

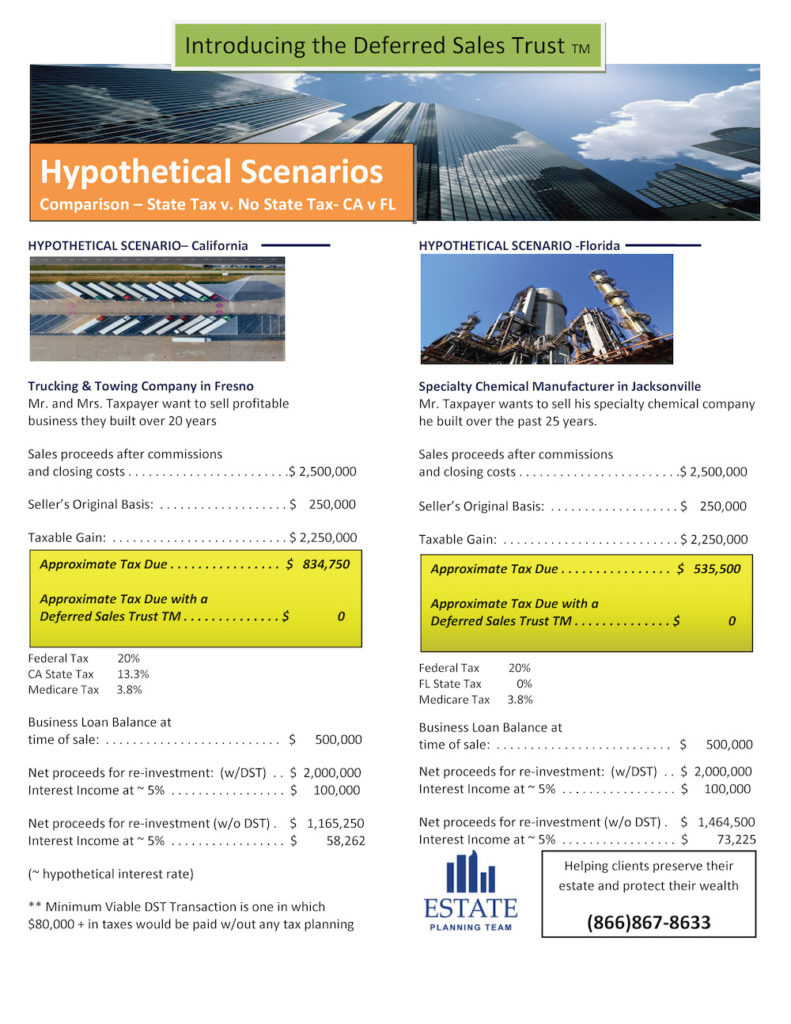

The Deferred Sales Trust, or DST is a legal, proven, and IRS-tested tax strategy designed to help Sellers of highly appreciated assets to defer the ordinary income taxes and capital gains taxes over a period of years instead of paying them all in a lump sum. The Deferred Sales Trust gives the Seller/Taxpayer the ability to control their capital gains tax exposure, reinvestment terms, and installment payments made from the trust.

Murphy Business Conference Presentation

For those in attendance at the 2023 Murphy Educational Conference in Florida, some may have had the opportunity to stop by the Estate Planning Team’s booth or attend one of our breakout sessions. If you did you would have spoken with Greg Reese or Greg Richards and learned more about the possibilities of how a DST can specifically assist you in closing more deals and being more valuable to your clients. To elaborate further on this, Reef Point has prepared a presentation specifically for you and your colleagues. Please view it below.

Do you have a current prospective client that could use a DST?

Click to fill out the DST Analysis Questionnaire

A Partnership with Reef Point, Greg Reese, and the Estate Planning Team

A partnership with The Estate Planning Team and Reef Point, LLC enables you to refer your clients to legal and tax professionals that specialize in this tested and proven strategy, which most lawyers and CPAs are not well versed in. You will not be asked to provide legal or tax advice to your clients, rather our team assists in those matters.

We can provide free initial advice and analysis on whether this tax deferral strategy will work for your clients. By partnering with The Estate Planning Team (EPT) & Reef Point, you become part of a team of professionals collaboratively working to serve a client’s tax deferral objectives. As an EPT & Reef Point partner you’ll gain the following:

- Education by EPT & Reef Point on all facets of DST’s so you can better serve your clients

- Marketing assistance and content

- Client PowerPoint presentations

- Seminar tool kit

- Help in analyzing potential transactions with you

- Collaboration with you, your clients, and their advisors

- The support of tax and estate planning experts

- Personalized lead generation websites

- Regular training webinars

- For Business Brokers & M&A Professionals, you can offer “A Way Out” and sell more businesses

- For Real Estate Professional, you’ll increase listings opportunities and provide clients with value add services

- For all partners, you’ll Create a Competitive Edge and Value Add Service over the Competition

Interested in becoming a Reef Point Partner?

Fill out the form to request an appointment to learn more about becoming a Reef Point affiliate.

Conference Lead

*Minimum Viable Transaction

When considering selling an appreciated asset, if the expected tax liability without any particular planning would cost $80,000 to $100,000 or more in taxes, then the DST should always be considered. Said another way, if the amount of the gain or profit that will be taxed on is at least $250,000, then YES you should look into the DST.

Resources

A wealth of resources are provided to our partners. Some highlights include educational material, case studies, pitch decks, videos and more.

![[Video] How to Incorporate Deferred Sales Trusts Into Your Business to Increase Real Estate Listings and Business Sales | Reef Point LLC](https://reefpointusa.com/wp-content/uploads/2021/01/Video-How-to-Incorporate-Deferred-Sales-Trusts-Into-Your-Business-to-Increase-Real-Estate-Listings-and-Business-Sales-Reef-Point-LLC-optimized.jpg)