Business Exit Strategy

As a business owner, you know that every major business decision demands vigilant thought and preparation. This is true for your biggest business decision: Your Exit Strategy.

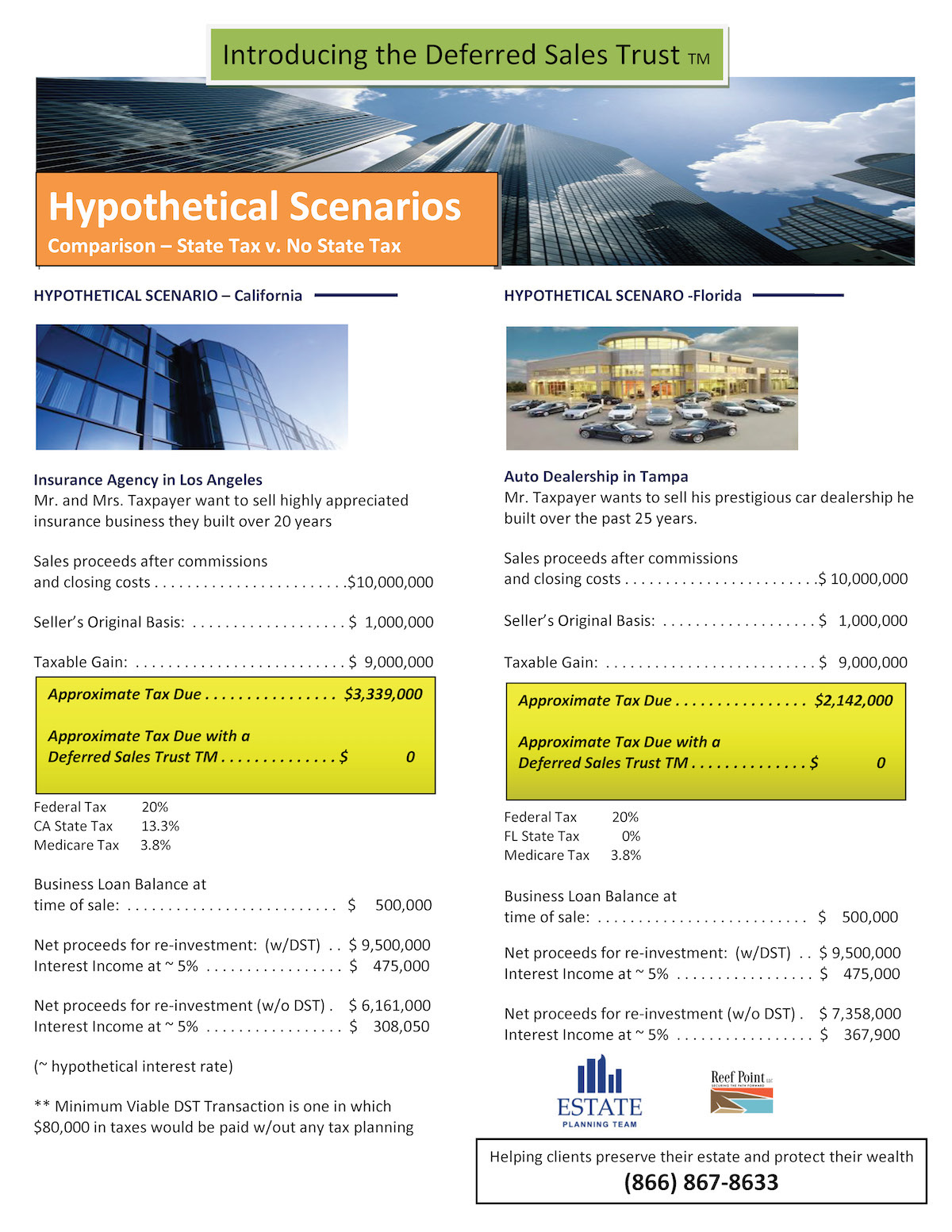

If you are considering the sale of a business, corporation, or investment real estate, you may face capital gains taxes associated with the sale. For the investor who does not want to continue holding investment property or remain in the same business, a Deferred Sales Trust should be considered. According to section 453 of the Internal Revenue Code, the Deferred Sales Trust provides investors a solution whereby they can defer capital gains upon sale of their assets and redirect the sale proceeds into cash or whichever types of investments suit their needs, income requirements, and objectives.

The DST utilizes a legal and established method to allow the Seller of the business to defer capital gain taxes due at the time of sale over a period of time that is selected by the Seller/Taxpayer in advance.

The Deferred Sales Trust can be used with any kind of entity, e.g. LLCs, S or C election corporations, as well as individuals who own real estate, rental properties, vacation homes, commercial properties, hotels, land, industrial complexes, retail developments, and raw land, to name a few.

Over the long run, the Deferred Sales Trust has the ability to generate substantially more wealth than a direct and taxed sale. It may be superior to the Charitable Remainder Trust , installment sale or like-kind property exchange in many respects. Consult your tax advisor to ascertain the potential benefits of this option.

How does the Deferred Sales Trust work?

- The process starts with initial due diligence and prospective marketing and market research. If the transaction is viable, the trust and property owner will negotiate to reach terms with regard to the asset(s). If the transaction is feasible, the property owner (“Seller/Taxpayer”), selling ownership of the property/capital asset to a dedicated trust (the “Trust”) that is set up specifically for the Seller/Taxpayer and the contemplated transaction.

- The Trustee (must be DST Trained and Approved) of the Trust pays the Seller/Taxpayer for the property/capital asset. The payment isn’t in cash, but with a special payment contract called an “installment sales contract”. It is strictly a private arrangement between the Trust and the Seller/Taxpayer. The term of payments is established in advance and pursuant to the sale contract negotiated by and between the Seller/Taxpayer and the Trustee payments may begin immediately or they may be deferred for some period of months or years.

- The Trust sells the property. There are generally minimal capital gains taxes due from the Trust on the sale since the Trust often purchases the property for a price and value similar to what it may get sold to a third-party Buyer.

The Seller/Taxpayer is not taxed on the sale since he has not yet received any cash for the sale. Often Seller/Taxpayers will choose deferral because they have other income and don’t need the payments right away. Of course, the payments may begin immediately.

Deferral is strictly an option. It is important to understand that payment of the capital gain tax to the IRS is done with an “easy installment plan” as the Seller/Taxpayer receives the payments. Part of the payment received is tax free return of basis, part is return of gain which is taxed at capital gain rates, and part is interest. On top of that, the tax payments will be made with depreciated dollars. The tax dollars will likely be worth less than they are today due to inflation. If invested properly, the money in the Trust could potentially grow at a greater rate than that of inflation and even the distribution rate and ensures the necessary liquidity to pay back the note due to the Seller/Taxpayer. (The interest rate in the note to you is dictated by the IRS to be a fair and arm’s length or competitive rate, i.e. 6% to 8%.)

While we have primarily focused on capital gains tax, the amount of gain due to straight line depreciation is also deferred with a DST. But if you have taken accelerated depreciation in excess over straight line, this amount cannot be deferred.

See our Business Exit Strategy Case Study Comparisons Below